Bitcoin. Inflation. Amber Heard. Junior Chicken.

Bank of Canada and the US fed change their story more than Amber Heard.

Canada’s inflation rate rose to to 8.1 per cent last month, a new 39-year high. Even worse, US inflation roared to 9.1 per cent, a fresh four-decade high last month.

What is Inflation?

Put bluntly, inflation is a rise in prices and and decline in purchasing power of your dollar. Do you remember paying $1.39 each for a Junior Chicken sandwich? I do. Today, $2.99 each for a Junior Chicken Sandwich. This is a simple example of inflation. I want to make love with Junior Chicken sandwich.

What causes Inflation?

An increase in the supply of money is the chief cause of inflation. Printing more money also known as Quantitative easing (QE) results in an increase in a country’s money supply. Most problematically, the currency gets devalued and ends up losing its purchasing power. Recall the example of Junior Chicken Sandwich.

Granted, I was in high school during the Global Financial Crisis (GFC) of 2008. The idea of Quantitative easing (QE) was alien to me but QE did occur in 2008-2009. By comparison, I was wide awake during the 2020 COVID-19 market crash. Consequently, money-printing skyrocketed in 2020. More precisely, over 40% of the Money US has ever printed in its history was printed in 2020. For inflation, this was like waving a red flag in front of a bull’s face.

Bank of Canada (BOC). The Federal Reserve. Recession. Controlling Inflation.

BOC, the US fed and most economists promised inflation was transitory less than a year ago. With horror, they were all dead wrong. Just this morning, it was announced second quarter in a row of negative real GDP in the US. Confusingly, White House secretary Karine Jean-Pierre claimed two consecutive quarters of negative GDP growth is not the definition of “recession”. Here’s the thing, though: A recession has always been defined as two consecutive quarters of negative GDP growth. Perhaps, they are redefining recession?

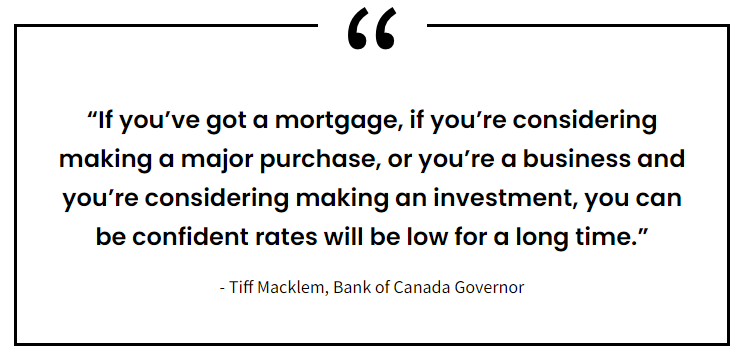

Who controls inflation? To be fair, BOC and the US fed do their best to control inflation. Strictly speaking, a country’s central bank will determine rate of growth of the money supply. In Canada, Tiff Macklem is one of the main man. Macklem was appointed Governor of the Bank of Canada on June 3, 2020, for a seven-year term.

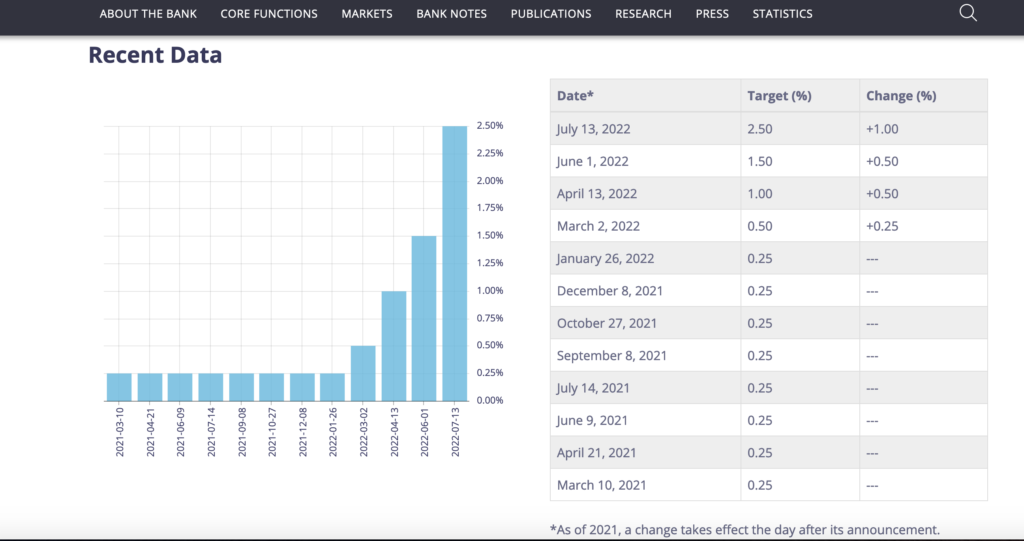

You might have noticed that the BOC has continued its policy of Quantitative tightening (QT) starting March of this year. QT is the opposite of QE. Why QT? Well, they are trying to tame inflation as Canada’s inflation rate rose to to 8.1 per cent last month, a new 39-year high. You can see below the change in interest rate. The next interest rate announcement will be announced on September 7, 2022.

Perhaps most remarkably, BOC had signalled no rate hikes until at least 2023. Tragically, BOC increased interest rate by 25 basis points on March 2, 2022. Even worse, BOC hiked 100 basis points just a couple of weeks ago and will likely do the same in September. Canadians are pissed. But in all frankness, I don’t blame them.

Bitcoin

Bitcoin gives me a ray of hope. Inflation has resulted in higher prices for everyday items. Investors like you and me are trying to figure out where to park our money. I remain bullish in Bitcoin, you can read why I am bullish here. Unlike BOC and the US fed who can easily print more USD and CAD, Bitcoiners keep reminding the world about Bitcoin’s most peculiar property i.e. there is a cap at 21 million. No one can print more Bitcoin. The contrast between Bitcoin and fiat currencies is most pronounced in the supply category.

Nevertheless, critics have rightly criticized Bitcoin stating it is not an effective hedge against inflation during times of economic turmoil. Bitcoin dropped more than 60 percent this year. Bear in mind, though Satoshi Nakamoto launched Bitcoin in 2009. Bitcoin is still young, barely a teenager. Even more crucially, Bitcoin is not dead. In fact, I believe the trend is more vibrant than ever. At heart (deep down), we all know inflation and Quantitative tightening (QT), raising interest rates crashed every market, not only Bitcoin. Some tech stocks were down more than 80 percent, gold was down, real estate was down, even bonds suffered. Despite falling more than 60 percent in 2022, Bitcoin’s performance over time speaks for itself.

Let me warn the reader: Bitcoin is extremely volatile today. Ultimately, once volatility smooths out, we will have a better picture of how Bitcoin will act as an inflation hedge.

What’s Next?

The next 6-12 months appear foggy. What happens next is anyone’s guess. Everyone is guessing. Will they keep raising rates or will they pivot? Do we remain in a bear market or will the market recover quickly like it did in 2020?

I don’t know.

I remain bullish in Bitcoin. My humble prediction is they will stop raising rates or start cutting rates by the end of this year (or early 2023).

They will start printing again.

I like Junior Chicken sandwich. I don’t like Amber Heard.

DISCLAIMER : None of this is financial advice. Please be careful and do your own research.